The US Department of Energy Just Confirmed Our More Oil And Natural Gas Reality Again

The U.S. Department of Energy’s Annual Energy Outlook 2020 (AEO 2020) was released at the end of January. And as always, the forecast offers keen insight into our energy future. Looking forward to 2050, the U.S. Department of Energy’s National Energy Modeling System makes clear: the ongoing importance of oil and natural gas is undeniable. Our shale revolution will remain the foundation of our "more oil, more gas."

Taking flight in 2008, U.S. crude oil production has exploded 160% to ~13.1 million b/d, while gas output has risen 65% to ~95 Bcf/d. Oil and gas meet over 60% of U.S. energy needs. Oil fuels 97% of our transportation, with gas generating almost 40% of our electricity (versus 20% in 2008).

Let us then look at just a few facts laid out by the U.S. Department of Energy’s AEO 2020. Low cost U.S. natural gas over the long-term might be the least reported forecast in our energy-environment discussion. Yearly, new domestic production has been outpacing new domestic demand two to four times over the past decade, keeping gas prices historically low and stable.

With production up ~13% in 2018 and then up another ~11% in 2019, prices have fallen even as exports soar. After the lowest summer gas prices since 1998, record output, a mild winter, and the coronavirus outbreak have Henry Hub gas prices lingering in the $1.80 per MMBtu range, the lowest in four years.

In turn, with the shale revolution ballooning U.S. proven gas reserves 85% to 450 trillion cubic feet, and while the industry relentlessly cuts costs with always improving technologies and operations, the U.S. Department of Energy’s has been forecasting lower and lower gas prices each time that it looks out into the future (Figure 1).

On an annual average, new domestic production is expected to double new domestic demand, leaving enough extra to cover exports and keep our own prices low. Remarkably, U.S. gas prices are now expected to stay below $3.70 for the next three decades at least. For reference, pre-shale from 2000 to 2008, gas prices averaged over $6.00.

Such low prices for natural gas will make it even more challenging for already more expensive and less reliable wind, solar, and battery storage to keep pace. But low gas prices will surely help our businesses, families, and economy. Not just giving our companies an essential global competitive advantage, cheap energy from shale continues to free up the consumer spending that accounts for 75% of U.S. economic growth. No wonder then that the U.S. Chamber of Commerce reported in December that a fracking ban would erase 19 million jobs and $7.1 trillion from the economy by 2025.

Further, as another conveniently ignored fact, low prices are locking in more gas usage and infrastructure. Last year alone, some 17 Bcf/d of additional U.S. gas pipeline capacity was approved by FERC in order to meet rising demand: "U.S. natural gas consumption sets new record in 2019." This equals almost 20% of current U.S. gas production. Such low gas prices accentuate gas’ favored position in the U.S. energy mix as a reliable, versatile, and low emitting energy source.

Gas is also critical in backing up intermittent renewables for those frequent times “when the wind isn’t blowing” and the “sun isn’t shining.” And remember that the International Energy Agency specifically credits more shale gas as to why we are slashing CO2 emissions faster than any country in "the history of energy."

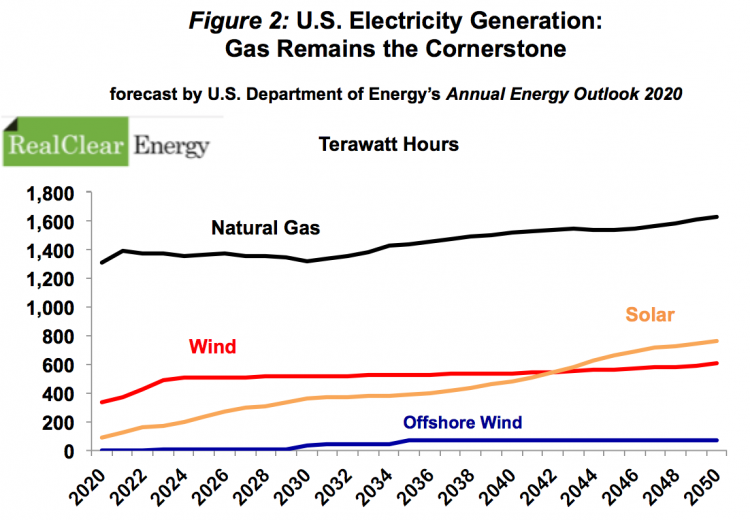

Indeed, low costs and high environmental performance will continue to make gas the backbone of the U.S. electric power system (Figure 2). Both wind and solar are growing but just two quietly emerging problems for them are: 1) an overdependence on fickle tax credits and 2) the gradual reduction of those "sweet spots" where the wind blows hard and the sun shines bright.

Using sunny California as the “solar example” for other states, for instance, really is as erroneous as it seems: "Keeping California's Great Solar Boom In Perspective." Further, the environmental goal of powering all sectors of the U.S. economy will have a very predictable result, surging the need for our most important source of that electricity: ‘Deep Electrification’ Means More Natural Gas." To illustrate, electric cars can spike home power usage by 60% or more.

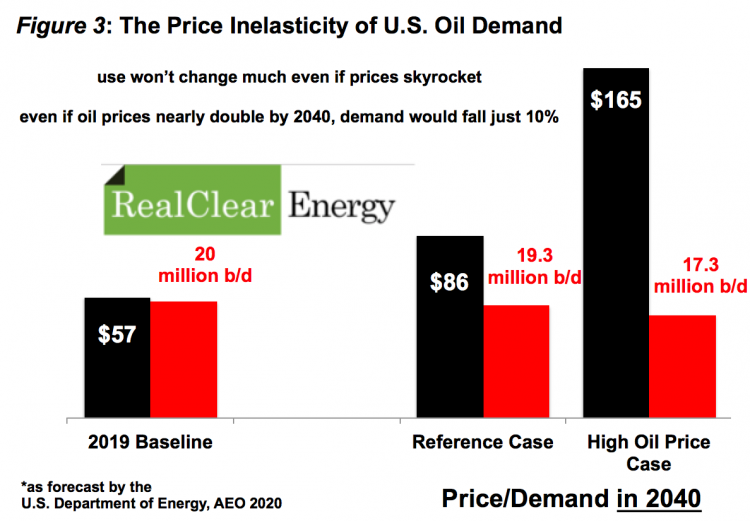

Finally, we must hit on what the U.S. Department of Energy envisions for our oil demand. After all, oil is our most important source, meeting ~33% of U.S. energy needs. At 19-21 million b/d, the U.S. oil requirement has remained “buoyantly very high” for 15 years. The ability of other options to displace oil routinely gets exaggerated. For example, electric cars, even with their high subsidies and tax credits, really are toys for the rich: the average Tesla buyer makes $400,000 per year – almost seven times more than the average U.S. family.

Not surprsingly then, the U.S. Department of Energy’s National Energy Modeling System reports that even if oil prices skyrocket our oil needs will not change very much (Figure 3). As the ultimate indispensible source of energy lacking material substitutes, we ignore that reality at our own peril - and to the delight of Russia, China, and OPEC.

Jude Clemente is Editor at RealClearEnergy.